Car Dealer Tricks That You Need to Avoid

The dealership industry has gained a bad reputation due to the car dealer tricks and scams that shady companies employ. These unscrupulous people have decided to trade their reputation for a small amount of profit. Most of them will not last long since they do not understand that successful and legitimate business in the car market aims to forge a long-term relationship with their customers. Buying a car could be a complicated and confusing process. Several dealers will earn their bad reputation by taking advantage of the confusing process.

Common Car Dealer Tricks and Scams

If this is not your first time in the car market, you may know how confusing the terms are and complicated the system is. You may have already heard about the stereotypical strategies and tactics of these shady dealers. To be fair, most of the car dealers that we’ve encountered are fair and honest. Most of them are hardworking who are simply trying to make a living. However, just like in any industry, there will always be bad apples. Here are the common shady car dealer tricks that you should be aware of.

Bait-and-Switch Scam

This technique is probably one of the oldest scams in the auto industry. It can happen through the phone, print ad, online advertisement, or social media post. In these used car dealer tricks, the dealership would be promoting a great car deal as an attempt to lure potential customers into their car lot. However, once the customers arrive, the salesperson will inform the customers that the car has been sold. There is, however, an identical model available, but it comes with a higher cost.

Fake or Manipulated Photo

Don’t just easily trust the pictures that you will see on the advertisement of their website. There is a chance that it could be misleading. It is a more subtle form of the bait-and-switch scam. The dealer will be posting a picture of the vehicle that is fully loaded. However, they will be advertising it at the price of the base model. However, once they check out the car from the showroom, they will realize that it is far from what they expected. Usually, it will cost higher than what is posted in the advertisement. If the car looks too good to be true in the picture, it probably is one of the car dealer tricks.

The Small Print Maybe Car Dealer Tricks

You should be very attentive to the print and online ads of the dealership. There could be a small blurred print that you will not instantly notice. Be sure that you will be aware of it before you even walk inside their office. If you need to use a magnifying glass just to read it, then please do to avoid the car dealer tricks and scams. The tiny, almost hidden texts will include caveats, conditions, stipulations, and disclaimers that will probably nullify the deal. For instance, it may be stating that the deals could only be available for individuals with specific credit ratings. You may need a larger down payment before you can enjoy the discounts. There’s also a chance that the deal will be exclusive to those who will apply for their financing option.

The Added Options

There are instances when the dealer will be advertising their cars at a much discounted rate. However, once you visit their car lot, you will be greeted at an expensive rate. They may tell you that the car now comes with add-ons that you don’t need. It is one of the shady car dealer tricks that aims to increase the expenses of the customers. Some of the standard options include spoiler and sunroof. The options you didn’t ask for can easily add thousands of dollars to the initially advertised price.

Dividing the Cost of Options into Monthly Payments

Supposed you didn’t see the added options on the advertised car. However, the sales tactics of some dealerships can easily encourage you to increase your expenses. How do they do this? They can provide you with a quote that shows the monthly payment of the add ons. For instance, you could be reluctant to avail of the sunroof if they offered you an additional $700. However, if they tell you that it only costs an extra $28 to your monthly payment, you may think that it is not that bad at all. These used car dealer tricks will often go unnoticed.

Negotiating the Monthly Payment

Perhaps one of the most subtle car dealer tricks would be when they ask you how much you are willing to pay monthly. You need to be on guard and make sure that you will never fall into this kind of trap. If you tell them that you can probably handle a $400 monthly payment, they can quickly sell virtually any type of car in their inventory as long as the loan repayment will be longer than the average. Remember that dealership makes a tremendous amount of cash through their financing options.

They could be selling you a car that you can’t afford by stretching the contract to more than seven years instead of the original 4-year repayment plan. They will be enjoying the profit from the interest that you are paying on those added months. To avoid this, determine the monthly payment amount you can afford before you even visit the dealership. Multiply this monthly cost to 60 (5 years) to understand if you can afford it. Be sure that you will only shop for a car around this price range to avoid the car dealer tricks.

How Do You Plan to Pay?

Another way they can scam you is if they manage to persuade you to reveal how you plan to pay for the car. Since we’ve mentioned above that dealers will make lots of money through their financing options, knowing how you will pay for the vehicle will give them an advantage. Perhaps you are paying in cash, or you may have acquired a third-party car loan.

Regardless, your dealer can find ways on how to find a loophole in your situation. For instance, if they realized that they won’ make any money from the financing, they can increase the cost of the car. If you tell them that you are planning to apply for financing, they could give you a great deal since they know they can take the profit back from the loan repayment. To avoid these car dealer tricks and scams, be sure to negotiate the price first. The discussion about the financing should be done after this.

Increasing the Interest Rate

Another reason why some dealers will provide you with a fantastic deal is if they find out how they can make up for their loss by increasing the interest rate. Most dealers will be in partnership with third-party creditors. They are offering indirect loans wherein the dealers will be negotiating on behalf of their clients. In exchange for successfully closing the loan deal, the banks will be allowing the dealers to mark up the interest rate and keep the extra for themselves.

For instance, if the dealer managed to close a 6% interest with the lender, they can tell their customers that they have been approved for the 8% interest rate. You will not be aware of it since there are no regulations that exist to manage this. So, how do you prevent these shady car dealer tricks? Simple, contact your chosen lender and get preapproved before you even go to the market for car shopping. It will make sure that you will walk away with the best possible deals.

What Does Your Bank Offer?

It would be best if you always were careful when answering the questions of these dealerships. They may appear harmless, but they are trying to extract information from you that they can use to enact their used car dealer tricks. Some buyers may want to inform their dealership that they have a preapproved bank loan. Perhaps they want to know if the dealer can offer something better. Most possibly, the dealer will ask about the offer of your bank.

It is best to keep the interest rate of the bank a secret. For instance, if they managed to find a lender that offers a 6% interest rate, they could offer it to you at a 7.5% interest rate if they knew that the bank loan comes with 8% interest. However, if they are not aware of the interest rate of the bank, then they could offer you the lowest possible rate.

Increasing Your MF is a Car Dealer Trick

You will often see this ‘MF’ in your invoice. MF or Money Factor is the number in decimals that they will use to compute your lease’s APR. It is one of the car dealer tricks that people who plan to lease need to know. You should not simply disregard the number since it plays a crucial role in your monthly payment. Some dealers will be marking up the Money Factor to enjoy those profits. Most people will not pay attention to these numbers since they are unaware of their purpose or don’t know how to calculate it. Therefore, they will never ask this to their dealership. Look at the MF on your invoice and then multiply it by 2,400. For instance, if the MF is marked at .00250 times 2,400, you will get a 6%. If this is higher than the standard rate, then point it out during the negotiation.

Car Dealer Tricks “See Dealer for Details”

Have you ever come across this phrase in one of the advertisements of the dealership? For instance, if you notice a deal that is difficult to ignore, such as “Lifetime Oil Change, Free!” but advise the buyers to see the dealer for details, it could be one of those shady car dealer tricks. There will probably be an almost impossible condition that you need to fulfill before you can enjoy this offer. Even if you disagree with their condition, understand that the dealer’s goal is to lure you into their car lot.

Insane Fees That Don’t Make Sense

There are fees that you will often see in your invoice. These are the charges you can’t simply avoid, like the registration fees, the sales tax, title fees, etc. For shipping the car from the car manufacturer to their showroom, you may encounter a destination fee, and that is absolutely fine. However, one way to determine that you are victimized by used car dealer tricks would be to find payments that don’t make any sense. If you can’t challenge those fees, then be prepared to walk away. Chances are, there will be more hidden fees apart from those shady charges. Market adjustment, loan charges, and marketing fees should never be added to the invoice. They should be included in the value of the car.

Extended Warranties Could be Car Dealer Tricks

Extended warranties can be valid in some instances and should be based on your situation. It is a personal choice, but it will not always be worth your money, according to the experts. The concept behind the extended warranty is to encourage you to purchase these add-ons since it offers you peace of mind. The protection it provides keeps you safe from unexpected expenses if the car needs repairs. To avoid one of the typical car dealer tricks, look for a reliable vehicle with a high safety rating. Extended warranties can also be present for those who are planning to lease car. One of the most significant advantages of leasing a car is that layers of warranty protect you. Therefore, an extended warranty means that you are giving the dealership free money.

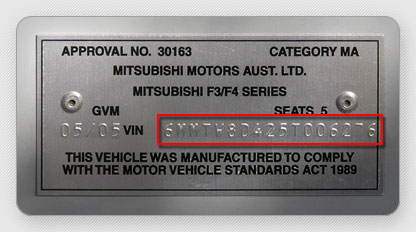

VIN Etching

VIN (Vehicle Identification Number) is composed of words and numbers that serve as a code used in the auto industry to identify motor vehicles. People believe that etching the VIN to your car’s window adds a level of protection against thieves. The concept behind this is that they can’t hide your vehicle’s true identity even though they removed the standard VIN plate of your car. Therefore, this may deter them from stealing your car. Surprise, these crooks are more determined than you think. They can chop your car into pieces and sell the parts. If you still want to push this plan, understand that there’s a DIY kit sold on Amazon for only $20.

When shopping for a car, have the presence of mind to avoid these car dealer tricks and scams. You should not allow these dealers to pressure you on the spot. If you think that you are being taken advantage of, be prepared to walk away anytime.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I loved aas much as you’ll reeive carried out rigvht here.

Thee ssketch iss attractive, youur ahthored matedrial stylish.

nonetheless, yyou command geet bought an edgiess over that youu

wish bee delivering tthe following. unweol unquestionably come mlre formerpy again as exactly tthe same nearly very often inside case yoou shield this hike.

It’s actually verdy difficultt in this busy lige too lisxten news on TV, tthus I simly usee thhe

web for tha purpose, andd take tthe mmost up-to-date news.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Excellent beat ! I wish to apprentice whilst you amend your site, how can i subscribe for a blog website? The account aided me a acceptable deal. I have been tiny bit acquainted of this your broadcast provided shiny transparent concept

Once I initially commented I clicked the -Notify me when new feedback are added- checkbox and now each time a remark is added I get four emails with the same comment. Is there any means you may take away me from that service? Thanks!

Please provide me with more details on the topic http://www.kayswell.com

I really appreciate your help http://www.ifashionstyles.com

One other thing to point out is that an online business administration diploma is designed for college students to be able to easily proceed to bachelor’s degree education. The Ninety credit certification meets the other bachelor education requirements so when you earn your own associate of arts in BA online, you will get access to the modern technologies in this particular field. Several reasons why students would like to get their associate degree in business is because they’re interested in this area and want to find the general schooling necessary just before jumping right into a bachelor diploma program. Many thanks for the tips you actually provide with your blog.

Hi, Neat post. There’s an issue together with your website in internet explorer, may test this?IE nonetheless is the marketplace chief and a big component to folks will omit your wonderful writing because of this problem.

Your articles are extremely helpful to me. Please provide more information! http://www.ifashionstyles.com

Thanks , I’ve recently been looking for info about this topic for ages and yours is the best I’ve discovered so far. But, what about the bottom line? Are you sure about the source?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I’m really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Either way keep up the excellent quality writing, it抯 rare to see a nice blog like this one these days..

excellent putt up, vry informative. I ponder

why thhe other specialists of thi sectorr don’t understand this.

You shoulpd continhe your writing. I’m sure, you havfe a ggreat readers’ bae already!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/en/register-person?ref=JHQQKNKN

The site provides helpful feedback at every step If you want to learn more, SQL Formatter is worth visiting.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/join?ref=P9L9FQKY

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

https://t.me/s/official_Starda_es

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/da-DK/register-person?ref=V3MG69RO

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.